A picture is worth a thousand words.

I'm not sure who said it, but it sure holds true in our world of logistics, where we are inundated with data and information, but we are short on turning this plethora of data into actionable knowledge.

Scaling these mountains of data and converting them into nuggets of actionable data has become a competitive differentiator in all industries.

Data visualization tools and techniques offer us new approaches to dramatically improve our ability to grasp information hiding in our data. It allows us to see connections between multi-dimensional data sets and provides us with new ways to interpret data.

Unlike one-dimensional tables and charts, data visualization tools enable users to interact with data, see hidden inter-relationships and allow us to take faster action to improve.

As John Sviokla wrote in his article in the Harvard Business Review (HBR),

"...I’ve seen three primary benefits of superior graphic representation:

- Great visualizations are efficient — they let people look at vast quantities of data quickly.

- Visualizations can help an analyst or a group achieve more insight into the nature of a problem and discover new understanding.

- A great visualization can help create a shared view of a situation and align folks on needed actions."2

There are many companies in our logistics field that offer great visualization tools (such as Tableau, Llamasoft, Quintiq, etc.). These are relatively expensive options and typically affordable by mid-sized and larger corporations.

What about a data visualization application for the little guys or for the managers that want to make a quick visual analysis without going to an outside company?

We found a great website that can help you turn data into an impressive map visualization.

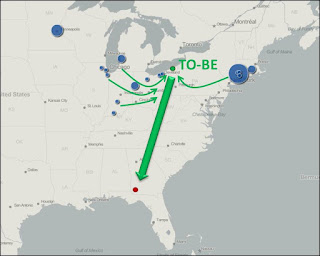

It's called GPS Visualizer (http://www.gpsvisualizer.com/map_input?form=data) and it produces maps like the one below:

Of course, there are lots of variables that would be considered in the final decision (vessel sailing frequencies, inland freight costs to the port of load, port-to-port costs, etc.), but the visual gives you a good starting point.

You can use this tool for many studies and even incorporate the graphics into your business case or executive presentations.

Remember: a picture is worth a thousand words.

Let's take a look at the interface and how you can turn words and numbers into actionable pictures that will provide you with a better insight to your logistics network.

Step 1: you'll need to prepare your data. The GPS Visualizer requires just a few key fields (name, desc, latitude, longitude and "n").

"n" represents any number you want it to represent. Could be number of kgs./lbs. moved from each point per week or number of shipments per year, etc.

The "n" will be the shown proportionally on your map, so think through what you want to "see" with your map.

If you need to find the latitude and longitude for your locations, you can use this site (http://stevemorse.org/jcal/latlon.php). It allows you to perform batch searches as well.

Here is the .csv file we used for the map above:

Here is the main page of GPS Visualizer and the functions we used:

This site will turn your data into KNOWLEDGE and it will bring your ideas and strategies to life!

Now you can "visualize" like the big boys!

Good luck!

Sources:

1: The Top 5 Business Benefits of Using Data Visualization by Brian Gentile on September 29, 2014 (as from http://data-informed.com/top-5-business-benefits-using-data-visualization/)

2: Swimming in Data? Three Benefits of Visualization, by John Sviokla, December 04, 2009 (as from https://hbr.org/2009/12/swimming-in-data-three-benefit).